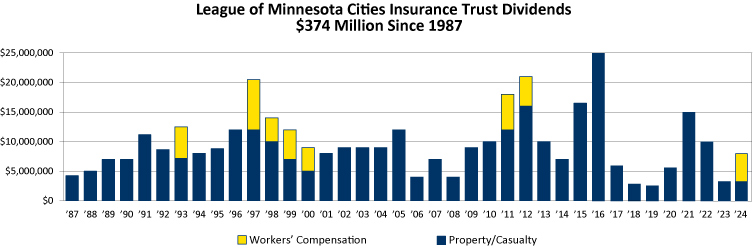

For 2024, members of the property/casualty program will share in a $3 million dividend and members in the workers’ compensation program will share in a $5 million dividend. Checks will be mailed in December to cities and other entities that are members of LMCIT as of Dec. 1.

LMCIT’s workers’ compensation and property/casualty programs are owned by the members of each program. If the LMCIT Board of Trustees determines the programs have more funds than necessary to pay operational costs and current and projected claims, they may return some or all of those funds to members in the form of a dividend. For 2024, the Trustees decided a dividend from both programs was appropriate.

While rate stability is a primary goal of LMCIT, unexpected outside factors can sometimes make that challenging. That was the case with legislative changes that made post-traumatic stress disorder (PTSD) a presumptive workers’ compensation condition for public safety workers. The best actuarial and claims handling information available at the time led to significant increases in workers’ compensation rates over the past five years to ensure sufficient funding for them. Fortunately, those claims have developed more positively than originally projected, leading to this year’s rate decreases and dividends.

That experience has highlighted the need to find new ways to provide rate stability even in times of uncertainty. One example is the recent development of an internal reinsurance fund that allows LMCIT to retain more risk in the face of an expensive property reinsurance market, much like a homeowner with a healthy savings account might raise their deductible in exchange for a lower premium.

The Trustees will continue to review the best uses of excess funds, returning a dividend when that makes sense and investing in other alternatives when those are most beneficial for members, all with the ultimate goal of providing broad, affordable, and stable coverage.