Shakopee Taxpayer Receipt Project Aims To Promote Transparency

By Deborah Lynn Blumberg

When residents receive their annual property tax notice or statement, it’s not uncommon for a bit of grumbling to ensue. Property tax statements can be complex, and residents want to understand how their tax money is being used.

In 2022, administrators in the City of Shakopee unveiled a bold new plan to help get ahead of any property tax discontent by being more transparent about city finances. Its Taxpayer Receipt project helps residents better understand how their tax funds are spent through an easy-to-use website that breaks down bills so residents can see how the city is spending money collected. A creative, entertaining video draws residents to the site, while a simple budget poster board in City Hall further breaks down tax-related figures.

Shakopee’s some 47,000 residents now have a better grasp of the factors that determine their bill, said Finance Director Nate Reinhardt. “Being able to communicate budget information is pretty difficult,” said Reinhardt, who’s worked in finance departments for 18 years. “Our goal was to try to be as transparent as possible and share information in a way people can understand it. We were looking for something creative that would draw attention. The tool and the video really checked all the boxes.”

The City of Shakopee was one of the recipients of the League’s 2024 City of Excellence Awards for its initiative.

Giving residents a simple tax receipt

Reinhardt and colleagues picked Polco’s Taxpayer Receipt tool for its ease of use. The software costs the city around $2,800 a year. When residents visit Shakopee’s customized Polco site, they answer two simple questions: do they own a home, and if so, what is their home’s taxable market value?

Then, the site generates an itemized receipt, much like shoppers would get at the grocery store. “It’s a format that people are familiar with,” Reinhardt said.

Residents see what portion of their taxes go toward a variety of city services based on their home value. For example, the ice arena, police, and street maintenance. For many people, a general budget number of $430,000 for snow removal, for example — Shakopee’s 2024 figure — can feel overwhelming. But when a resident who owns a $350,000 home sees through the tool that they’re paying $12.77 for snow removal for the year, it’s an easier number to take in.

“Nobody wants to think about their property taxes, and sometimes ignorance is bliss,” said Shakopee Communications Manager Amanda McKnight, “but this is a good way for people to see how their money is being spent.”

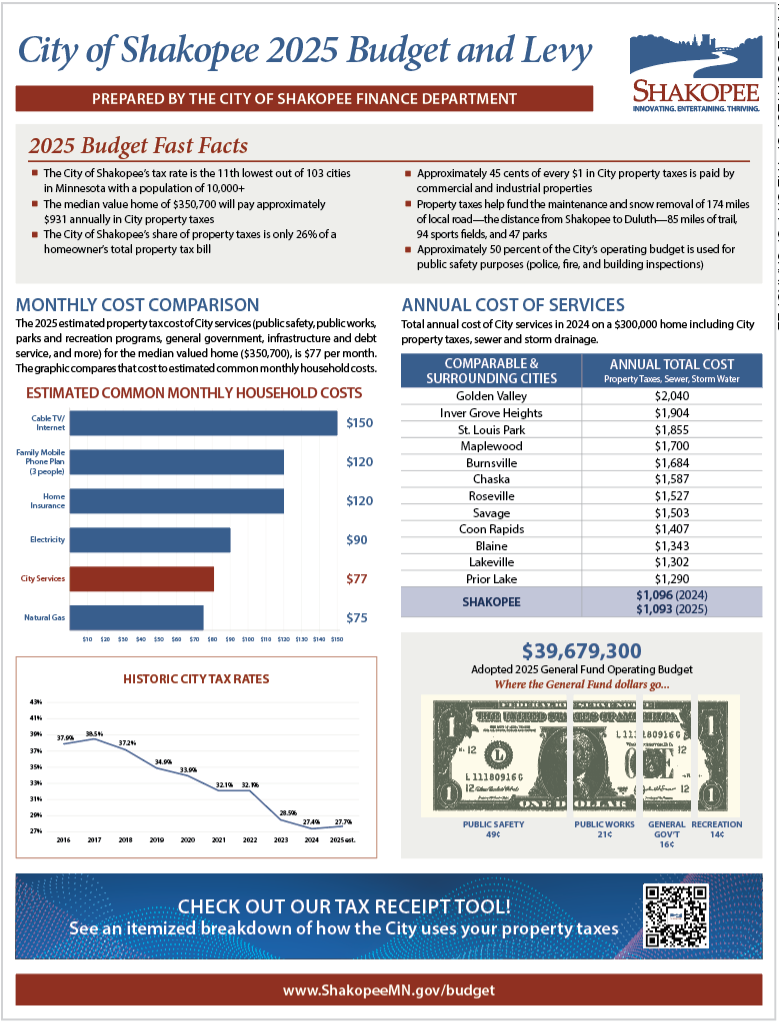

Around the same time, Reinhardt and colleagues created a budget board to make the city’s finances even more transparent. The large, one-page poster board with easy-to-understand charts and graphs sits just inside City Hall for all to see. It explains in simple language where the city will use tax funds in the upcoming fiscal year. The finance team partnered with communications colleagues to create the board.

The board starts with a series of bulleted budget fast facts. For example, that the City of Shakopee’s tax rate is the 11th lowest out of 103 cities in Minnesota with a population of 10,000 residents or more. Another fast fact shares that the median value home in Shakopee of $350,700 will pay around $931 annually in city property taxes.

To put costs in context, a bar graph compares the 2025 estimated property tax cost of city services on a median value home at $77 to monthly household expenses like cable TV/internet ($150), home insurance ($120), and electricity ($90).

A straightforward chart compares the annual cost of city services in Shakopee to a list of its comparable cities. Finally, a graphic of a chopped-up dollar bill illustrates how Shakopee’s adopted 2025 general fund operating budget of approximately $39.7 million will be allocated. For example, for each dollar, 49 cents goes to public safety, 21 cents to public works, 16 cents to general government, and 14 cents to recreation.

A QR code at the bottom of the poster directs residents to the tax receipt tool. Breaking down and personalizing budget numbers in this way can make a big difference, said Reinhardt.

“An almost $40 million operating budget seems huge, and people wonder, what is the city spending all of that money on?” he said. “But, depending on your home value, you’re really only paying some $900 of that amount, and you’re getting all these things. When people realize how much they’re getting in value, that really puts it into perspective.”

Shakopee updates the poster board and data that feeds the tax tool to reflect its current budget and final tax rate. Reinhardt said the city has gotten positive feedback on both from residents, staff, and council members.

“Comments that stood out have been, ‘why doesn’t the county do this, why doesn’t every city do this?’” he said. “That’s a sign of appreciation.”

A tongue-in-cheek video to drive website visits

The city advertised the new tax receipt tool on its website and social media sites, and residents started to use it. In late 2023, officials wanted to attract even more people to the site.

Reinhardt had seen a video explaining the operating budget of the City of Austin, Texas, through a Legos demonstration. It got him thinking that Shakopee could produce a creative video of its own. Reinhardt talked to McKnight and the city’s communications specialist and digital video expert Andrew Coons.

At first, the idea was hazy. “We wanted to build awareness and boost traffic to the receipt’s site,” McKnight said. Reinhardt, McKnight, Coons, and the city’s graphic designer, Deb Noble, talked about an infographic-heavy video or one that was fully animated with a voiceover. What they ended up producing was even more dynamic, and just plain fun. Coons, who had been with the city for just a few months, was charged with writing the script.

“The more I played with it, I realized there’s really not much to do — you go to the website, type in two numbers and hit enter. That doesn’t really make for a compelling long-form video. That really became the hook — it’s so simple — let’s play into that.”

Coons’ tongue-in-cheek script included jokes, and featured city employees as actors — including McKnight, who starred in the production and was a self-professed “high school theater kid.” Filming started in December 2023. Staff also helped with production, holding lights during the shoot, and appearing in cameos. It was a fun staff bonding experience, Reinhardt said.

Scenes take residents through difficult scenarios, contrasting them with the tax receipt tool. One scene takes place in a living room where “residents” watch a Vikings game. In another, three women, including McKnight, compare hotdishes. The team took less than three months from starting to write the script to the video’s release in early 2024.

Fewer tax-related calls and inquiries

The week of the release, the “It Really Is That Simple!” video was viewed 15,000 times across social media platforms, including on YouTube and Facebook.

“It’s cheesy, a little bit hammed up, and not what you would expect,” McKnight said. “People appreciated the humor in it, and it did seem to increase traffic to the tax receipt’s site for a while. I hope it inspires other cities to go out on a limb.”

Filming and editing the video was cost effective since the city had its own video equipment. Coons created a special vertical version for Instagram Reels, which added time to the editing process, but not enough to be a deterrent. To boost the video on social media, the communications team spent a few hundred dollars. “All it took really was staff time and gas money,” McKnight said.

Since Shakopee implemented the tax receipt tools, City Administrator Bill Reynolds, Assistant City Administrator Chelsea Petersen, and the finance department have all encountered fewer calls and visits from residents inquiring about how their tax dollars are spent.

“We will get inquiries once the budget passes, and people are getting their property tax statements,” McKnight said. “Last year, anecdotally, there was less of that.”

To other cities considering out-of-the box solutions to demystify the budget and property taxes, McKnight said, trust your team. “We all knew this was a risky idea trying to make budgeting and taxes funny, but it was really fun,” she said. “We received lot of accolades and attention. So, if your team has a kooky idea, but it just might work, it may be worth taking the risk.”

Deborah Lynn Blumberg is a freelance writer.