(Updated Nov. 7, 2024)

Important deadline to obligate ARPA funds approaching.

Avoid potential clawbacks of ARPA funds by obligating remaining ARPA funds by Dec. 31, 2024. To learn more:

- Read NLC’s article “Obligate it or Lose it! Preparing for the Upcoming ARPA SLFREF Obligation Deadline.

- Watch the U.S. Treasury webinar Updated FAQs on Obligations.

- Review the U.S. Treasury Updated FAQs and Obligations slide deck.

- Treasury’s SLFRF FAQs.

- Obligation Interim Final Rule.

- Obligation Interim Final Rule Quick Reference Guide.

Quick link to LMC’s FAQs related to obligation.

View a Step-by-Step Video Guide to Filing the April 30 Project and Expenditure Report.

This video is provided by the National League of Cities and is 10 minutes long.

April 30, 2025, is the deadline for non-entitlement units (NEUs) to file the ARPA Project and Expenditure Report

If your city has a population below 250,000 residents and was allocated less than $10 million in State and Local Fiscal Recovery Funds (SLFRF), then you have an annual filing requirement. You are required to file the Project and Expenditure Report by April 30, 2025, for activity that occurred during the reporting period between April 1, 2024, and March 31, 2025.

A Project and Expenditure Report is required even if all APRA funds have been spent and reported on a previous report. In this situation, report zero obligations and zero spending for the current period. Total cumulative obligations and total cumulative expenditures should equal the ARPA funds allocated to the city when all spending is complete.

Get answers to these FAQs about the American Rescue Plan Act (ARPA) Reporting:

NEU Agreements and Supporting Documents Report

Q1. How do I set up an account in Login.gov?

Q2. I set up an account in Login.gov. How do I get to the U.S. Treasury reporting portal?

Q4. How Do I verify the recipient profile and point of contact list?

Q5. I see more than one NEU listed under SLFRF Compliance Reports. What should I do?

Q7. How do I assign roles in the Treasury portal?

Q8. What are the reporting roles? Who can have what?

Q9. Why can’t I enter data or assign roles?

Q12. When is the NEU Agreements & Supporting Documents Report due? (Updated Feb. 21, 2023)

Registration on SAM.gov

Q13. Do I need to register or update my registration with SAM.gov?

Q14. How much does it cost to establish or change a SAM.gov account?

Q15. How do I update my SAM.gov registration?

Q16. My SAM.gov unique entity identifier has changed and is no longer my DUNS number. What happened?

Q17. How do I change the administrator on the SAM.gov account?

NEU Project and Expenditure Report

Q18. Where can I find the Project and Expenditure User Guide? (Updated Nov. 7, 2024)

Q19. Is there a video that walks through the reporting process?

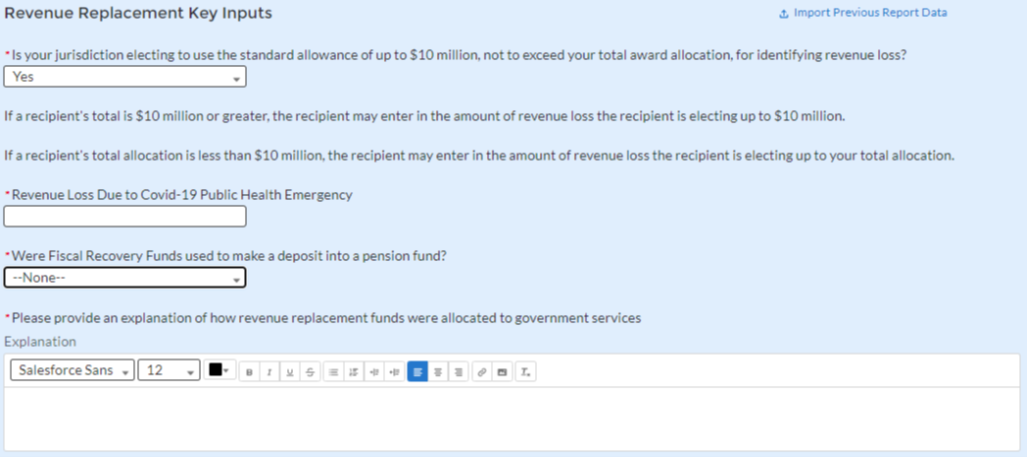

Q20. When is the Project and Expenditure Report due? (Updated April 8, 2024)

Q21. What is the reporting period? (Updated April 8, 2024)

Q22. What is the standard allowance? (Updated April 8, 2024)

Q23. What is the deadline to elect the standard allowance? (Updated April 8, 2024)

Q24. We haven’t spent any ARPA funds yet. Do we need to file the Project and Expenditure Report?

Q25. How do I find the reporting portal?

Q26. Once logged in to the portal, where do I find the Project and Expenditure Report?

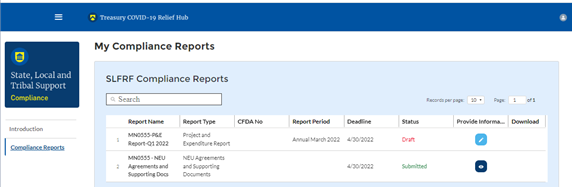

Q27. The SLFRF Compliance Reports list includes more than one report. Which one should I pick?

Q29. What do I need to do on the Recipient Profile tab?

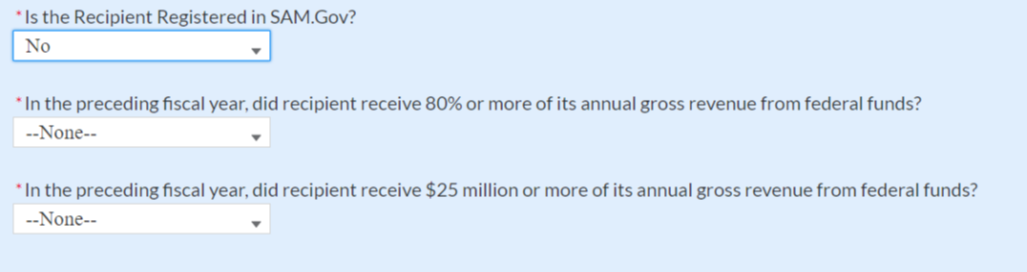

Q30. Is an active SAM.gov registration required?

Q32. Under the standard allowance do I need to enter a project for each project?

Q34. How do I elect the standard allowance on the April 30, 2022, Project and Expenditure Report?

Q39. How do I make a correction to the Project and Expenditure Report? (Updated Jan. 30, 2023)

Q40. Where can I find data and tools that detail pandemic spending? (Added Jan. 30, 2023)

Q41. What is ARPA Flex? (Added Jan. 30, 2023)

Q42. Is the US Treasury SLFRF Help Desk open? (Added Jan. 30, 2023)

Q43. How long do we have to spend ARPA Funds? (Added Jan. 30, 2023)

Q44. What’s new for 2024? (Updated Nov. 7, 2024)

Obligations

Q45: What is the definition of “obligated?” (Added Nov. 7, 2024)

Q46: What is NOT considered obligated? (Added Nov. 7, 2024)

Q47: Is there a date that ARPA funds must be obligated? (Added Nov. 7, 2024)

Q48: If the standard allowance under the revenue replacement provision was elected, are funds automatically considered obligated? (Added Nov. 7, 2024)

Q49: What if ARPA funds are not spent or properly obligated by Dec. 31, 2024? (Added Nov. 7, 2024)

Q50: Where is more information about obligating funds found? (Added Nov. 7, 2024)

NEU Agreements and Supporting Documents Report

Q1. How do I set up an account in Login.gov?

A1. Step-by-step instructions are available from the U.S. Treasury. If you prefer a video, watch Reporting for Non-Entitlement Units of Local Government. Pressed for time? Skip to minute mark 12:17 to 19:57.

Q2. I set up an account in Login.gov. How do I get to the U.S. Treasury reporting portal?

A2. The U.S. Treasury portal is at portal.treasury.gov/compliance/s/.

Q3. Is there a User Guide to follow for the Non-Entitlement Unit (NEU) Agreement and Supporting Documents Report?

A3. Yes! The NEU and Non-UGLG Agreements and Supporting Documents User Guide provides instructions to NEUs on accessing Treasury’s portal, assigning reporting roles, and providing required documentation to Treasury.

Q4. How Do I verify the recipient profile and point of contact list?

A4. The NEU and Non-UGLG Agreements and Supporting Documents User Guide provides instructions. Or, if you prefer a video, watch Reporting for Non-Entitlement Units of Local Government. Pressed for time? Skip to minute mark 29:15 to 31:10.

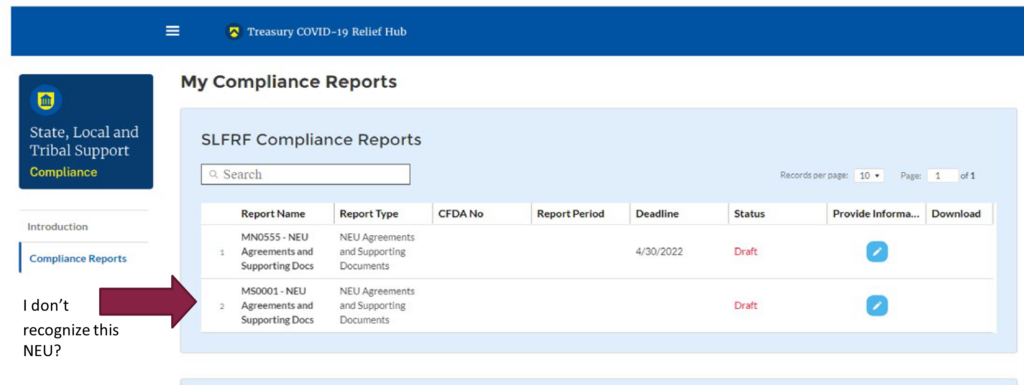

Q5. I see more than one NEU listed under SLFRF Compliance Reports. What should I do?

A5. Send an email to SLFRP@treasury.gov requesting they remove the report that doesn’t belong to your city.

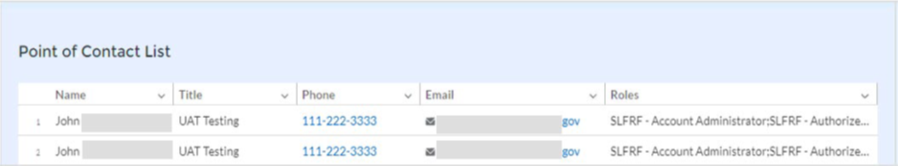

Q6. There are names on the Point of Contact list that aren’t affiliated with my city. What should I do?

A6. Email SLFRP@treasury.gov and request that the unrecognized names be removed.

Q7. How do I assign roles in the Treasury portal?

A7. The NEU and Non-UGLG Agreements and Supporting Documents User Guide provides instructions. Or, if you prefer a video, watch Reporting for Non-Entitlement Units of Local Government. Pressed for time? Skip to minute mark 19:58 to 26:08.

Q8. What are the reporting roles? Who can have what?

A8. Account Administrator

- Maintains list of designated individuals for reporting.

Point of Contact for Reporting

- Completes the SLFRF reports.

- Receives official Treasury notifications about reporting, alerts about upcoming reporting, requirements, and deadlines.

Authorized Representative for Reporting

- Certifies and submits official reports and communications with Treasury on such matters as extension requests and amendments of previously submitted reports.

One individual may be designated for multiple roles or all three roles. Multiple individuals can be designated for each role or all three roles. An organization may make changes and updates to the list of designated individuals whenever needed. These changes must be made by the Account Administrator.

Q9. Why can’t I enter data or assign roles?

A9. The Account Administrator has the administrative role of maintaining the names and contact information of the designated individuals. Check the roles assignments on the Point of Contact List.

Q10. The Treasury wants a copy of the signed Award Terms and Conditions Agreement, signed Assurances of Compliance with Title VI of the Civil Rights Act of 1964 and Actual Budget Documents. How do I get the required documents to the Treasury?

A10. The NEU and Non-UGLG Agreements and Supporting Documents User Guide provides instructions. Or, if you prefer a video, watch Reporting for Non-Entitlement Units of Local Government. Pressed for time? Skip to minute mark 31:11 to 37:22.

Q11. Where can I find the agreements and supporting documents to be submitted with the NEU Agreement and Supporting Document Report?

A11. The following three documents must be filed with ARPA NEU Agreement and Supporting Documents Report:

- Signed Award Terms & Conditions Document (pdf)

- Signed Assurances of Compliance with Title VI of the Civil Rights Act of 1964 (pdf)

- Budget documentation validating submitted annual total operating budget for calendar year 2020. The Office of the State Auditor Summary Budget Data Report (pdf) may be helpful.

Q12. When is the NEU Agreements & Supporting Documents Report due?

A12. This one-time reporting requirement was due April 30, 2022.

Registration on SAM.gov

Q13. Do I need to register or update my registration with SAM.gov?

A13. Yes! An active SAM.gov registration is one of the terms of ARPA funding.

To obtain a SAMS ID, the system requires cities to enter their year of incorporation. Incorporation documents can often be located on the Minnesota Legislative Reference Library website.

To retrieve your incorporation documents:

- Type the city’s name into the “Full Text Search” box with “—All—” selected for “Card group.”

- If you locate the document, type the file number listed into the “Document #” box and select “Retrieve Document.”

- Clicking the “PDF” link under the header “Full File” does not pull up a PDF of the incorporation documents; you must type the proper number into the “Retrieve Document” box and select “Retrieve Document.”

If the city’s incorporation documents do not come up after the search for the city, the documents often may be located by contacting the Minnesota Office of Secretary of State or the county auditor. Contact the Secretary of State at (651) 296-2803, (877) 551-6767 (9 a.m. to 4 p.m.), or business.services@state.mn.us.

Q14. How much does it cost to establish or change a SAM.gov account?

A14. Nothing! There is never a fee. The United States federal government does not charge or require any fees to be registered into the System for Award Management, nor does it charge any fee to receive assistance from the Federal Service Desk, which is the help desk for SAM.gov.

Q15. How do I update my SAM.gov registration?

A15. Instructions are provided on the SAM.gov website.

View the Quick Start Guide for Updating Entity Registrations (pdf)

Q16. My SAM.gov unique entity identifier has changed and is no longer my DUNS number. What happened?

A16. On April 4, 2022, the unique entity identifier that was used across the federal government changed from the DUNS Number to the Unique Entity ID (generated by SAM.gov).

- The Unique Entity ID is a 12-character alphanumeric ID assigned to an entity by SAM.gov.

- As part of this transition, the DUNS Number has been removed from SAM.gov.

- Entity registration, searching, and data entry in SAM.gov now require use of the new Unique Entity ID.

- New entities can get their Unique Entity ID at SAM.gov and, if required, complete an entity registration.

Learn how existing registered entities can find their Unique Entity ID

Q17. How do I change the administrator on the SAM.gov account?

A17. A notarized letter on city letterhead signed by the authorized signature authority (likely the mayor) is required to obtain access. A sample letter and instructions for submitting the request are found on the SAM.gov website.

Learn how to become the new administrator for your entity registration

NEU Project and Expenditure Report

Q18. Where can I find the Project and Expenditure User Guide?

A18. This guide is available on the U.S. Treasury Department’s website.

View the October 2024 Project and Expenditure Report User Guide (pdf).

Q19. Is there a video that walks through the reporting process?

A19. Yes! There is a 23-minute video that provides step-by-step reporting instructions for those electing the standard allowance.

View the video: State & Local Fiscal Recovery Funds: Project & Expenditure Reporting Part 1

Q20. When is the Project and Expenditure Report due?

A20. The next report is due April 30, 2025. This report will cover activity from April 1, 2024 to March 31, 2025 for annual reporters.

Q21. What is the reporting period?

A21. April 1, 2024, to March 31, 2025.

Q22. What is the standard allowance?

A22. Recipients may elect a “standard allowance” of $10 million to spend on government services through the period of performance. (March 3, 2020, to Dec. 31, 2024, or Dec. 31, 2026, for projects in process). Under this option, which was newly offered in the final rule, Treasury presumes that up to $10 million in revenue has been lost due to the public health emergency and recipients are permitted to use that amount (up to the full award amount but not to exceed the award amount) to fund “government services.” The standard allowance provides an estimate of revenue loss that is based on an extensive analysis of average revenue loss across states and localities, and offers a simple, convenient way to determine revenue loss, particularly for ARPA’s smallest recipients. All recipients may elect to use this standard allowance instead of calculating lost revenue using the formula. Recipients were asked to make this election during the April 2022 reporting deadline. Recipients may update their revenue loss determination, as appropriate, through the April 2025 reporting period. Upon update, any prior revenue loss election will be superseded.

Recipients may use ARPA funds on government services up to the revenue loss amount, whether that be the standard allowance amount or the amount calculated using the formula approach. Government services generally include any service traditionally provided by a government unless Treasury has stated otherwise. Here are some common examples, although this list is not exhaustive:

- Road building and maintenance, and other infrastructure

- Health services

- General government administration, staff, and administrative facilities

- Environmental remediation

- Provision of police, fire, and other public safety services (including purchase of fire trucks and police vehicles)

Government services is the most flexible eligible use category under the ARPA program, and funds are subject to streamlined reporting and compliance requirements. Recipients should be mindful that certain restrictions, which apply to all uses of funds, apply to government services as well. These restrictions include deposits into pension funds, debt service, replenishing financial reserves, settlements and judgments, or any projects that conflicts with or contravenes the purpose of the American Rescue Plan Act.

Q23. What is the deadline to elect the standard allowance?

A23. The deadline to make this election has been extended to April 30, 2025. Originally, this election was only available once and had to be made on the Project and Expenditure Report due April 30, 2022. Based on recipient feedback and in anticipation of additional questions related to the revenue loss election, Treasury has decided to keep this portion of the reporting portal open for recipients in upcoming reporting cycles, which will permit recipients to update their prior revenue loss election, as appropriate. Upon update, the prior revenue loss election will be superseded. Recipients continue to be required to employ a consistent methodology across the period of performance (i.e., choose either the standard allowance or the regular formula), and may not elect one approach for certain reporting years and the other approach for different reporting years.

Q24. We haven’t spent any ARPA funds yet. Do we need to file the Project and Expenditure Report?

A24. Yes, the report is required even if no funds have been spent. As a reminder, ARPA funds that have not been spent or obligated by Dec. 31, 2024, will need to be returned to the Treasury.

Q25. How do I find the reporting portal?

A25. It is available on the U.S. Treasury website.

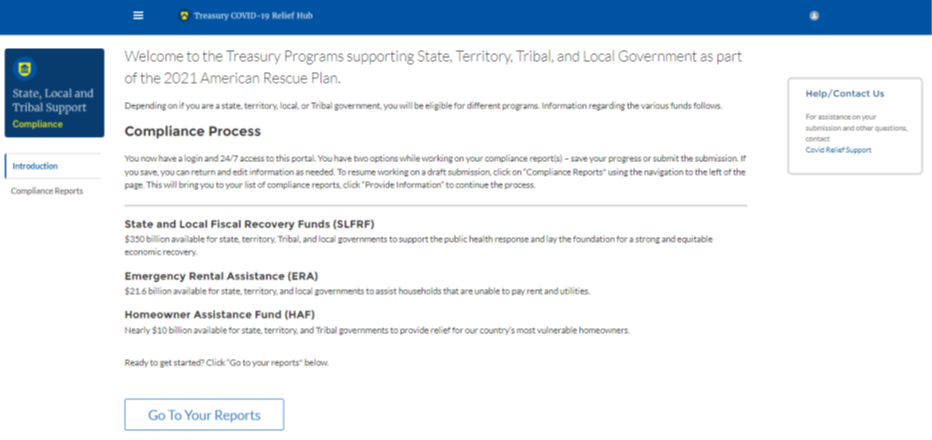

Q26. Once logged in to the portal, where do I find the Project and Expenditure Report?

A26. On the welcome page, click on “Go To Your Reports” at the bottom of the page.

Q27. The SLFRF Compliance Reports list includes more than one report. Which one should I pick?

A27. Select Project and Expenditure Report by clicking on the pencil icon in the Provide Information column.

Q28. My city is electing the standard allowance do I need to download the templates on the Introduction/Bulk Templates tab?

A28. No, you can move on to the next tab, Recipient Profile by clicking “next” at the bottom of the page.

Q29. What do I need to do on the Recipient Profile tab?

A29. Verify that all information is accurate. If corrections are needed, enter them in the narrative box.

Q30. Is an active SAM.gov registration required?

A30. Yes. You can file the Project and Expenditure Report if SAM.gov account is not active and should do so only if you are unable to successfully reactivate or register with SAM.gov by the report due date of April 30. It is important to file the Project and Expenditure report on time. If you are not registered in SAM.gov, select “No” from the drop-down menu. Two additional questions will populate the space below. These are yes/no questions. Select your answer from the drop-down menu.

Q31. My city hasn’t made spending decisions yet. Do I need to make any entries on the Project Overview tab?

A31. Yes. For the question, “Does your jurisdiction have projects to report as of this reporting period?”, select “My jurisdiction has projects to report” or “My jurisdiction does NOT have projects to report.”

If no projects will be reported, provide a narrative describing the reason(s) your jurisdiction does not have approved projects at this time in the text field provided. As a reminder, ARPA funds that have not been spent or obligated by Dec. 31, 2024, will need to be returned to the Treasury.

Q32. Under the standard allowance do I need to enter a project for each project?

A32. You can, or you can enter all spending under one project.

Q33. Can I skip the Subrecipient/Beneficiaries/Contractors tab, Subawards/Direct Payments tab, and Expenditures tab if my city elects the standard allowance?

A33. Yes. The standard allowance provides streamlined reporting. Move to the Recipient Specific tab.

Q34. How do I elect the standard allowance on the Project and Expenditure Report?

A34. The election is made on the Recipient Specific tab. Select “Yes” from the drop-down menu following the question, “Is your jurisdiction electing to use the standard allowance of up to $10 million, not to exceed your total award allocation, for identifying revenue loss?”

Q35. My city will elect the standard allowance and intends to use all ARPA funds under this provision of the American Rescue Plan Act. Do I include ARPA funds received in 2021, plus the second allocation expected in the summer of 2022 in the “Revenue Loss Due to Covid-19 Public Health Emergency”?

A35. Yes. The total allocation the city will receive is displayed in the Report Information box found on the right-hand side of the screen in the Project and Expenditure Report portal. If the city intends to use the full allocation under the standard allowance, enter the allocation amount as it appears in the Report Information box.

Q36. There is a question on the Recipient Specific page asking if any funds were deposited in a pension account. Is this an allowable use of ARPA funds?

A36. NEUs are not allowed to deposit ARPA funds in a pension account. The answer should be “no.”

Q37. There is a narrative box on the Recipient Specific page where an explanation of how revenue replacement funds were allocated to government services is requested. What if my city hasn’t committed funds?

A37. Enter as much information as you have available. If the council hasn’t committed funds, then explain that. If some funds have been spent and others are uncommitted, write a short narrative describing the spending and end with an explanation that decisions are pending on the remaining balance. As a reminder, ARPA funds that have not been spent or obligated by Dec. 31, 2024, will need to be returned to the Treasury.

Q38. After reading the Statement on the Certification tab and clicking on “Certify and Submit,” how do I know my report was submitted properly?

A38. You will see a pop-up box that states: “Are you sure you want to submit?” Click “Submit.” You then will see a green bar across the top of the screen that reads “Success … Your report has been submitted.” If you don’t see this message, scroll to the top of the screen and correct the items listed. Then, go to the Certification tab and click “Submit.” Your report is successfully submitted when the green bar appears.

Q39. How do I make a correction to the Project and Expenditure Report?

A39. After a recipient’s submission has been certified and submitted in the system by the Authorized Representative for Reporting, it can be corrected in the portal by selecting the “Unsubmit” button. Recipients may unsubmit, then resubmit, their Project and Expenditure Report any time before the reporting deadline. Once the report deadline has passed, the report will not be editable. Contact the SLFRF Help Center at SLFRP@treasury.gov.

Q40. Where can I find data and tools that detail pandemic spending?

A40. Pandemic Response Accountability Committee (PRAC) provides data and interactive tools that detail pandemic spending. Using these tools, users can drill down by state, county, or city to see how various pandemic relief funds have been used. This tool provides access to Project and Expenditure Report information filed by SLFRF recipients, details of Paycheck Protection Program recipients, and Restaurant Revitalization Fund grant details, among others.

Q41. What is ARPA Flex?

A41. The ARPA Flex provision provides additional flexibility for states, tribes, and local units of government to spend up to $10 million or 30% of the total ARPA funds received on the following newly eligible SLFRF grant expenditures:

- Spending to provide emergency relief from natural disasters, including temporary emergency housing, food assistance, financial assistance for lost wages, or other immediate needs.

- Spending on transportation infrastructure eligible projects and matching funds.

- Spending on any program, project, or service that would also be eligible under HUD’s Community Development Block Grant program.

For those who elected the Standard Allowance, some of these options may already be available under the general provision of government services.

Q42. Is the US Treasury SLFRF Help Desk open?

A42. Yes! Submit questions to the SLFRF Help Center at SLFRP@treasury.gov.

Q43. How long do we have to spend ARPA Funds?

A43. Under the SLFRF program, funds must be used for costs incurred on or after March 3, 2021. Further, funds must be obligated by Dec. 31, 2024, and expended by Dec. 31, 2026. This time period, during which recipients can expend SLFRF funds, is the “period of performance.”

Q44. What’s new for 2024?

A44. There are four notable changes to the system for the Annual Q1 2024 reporting cycle. These are:

- Federal Audit Clearinghouse (FAC) and Alternative Compliance Examination Engagement (ACEE)

Beginning in Reporting Period Q1 2024 there will be new questions in the Certification Tab that will ask for information related to FAC and ACEE. The information gathered from these questions will assist in determining next steps forward and if additional information is required. - Ready for Close Out

Beginning in Reporting Period Q1 2024 there will be a new question to determine if the recipient is ready for close out. This question has conditional requirements and will only be generated if the recipient’s expenditures are equal to the allocated amount. A response to this question is for informational purposes only and based on the response the recipient will receive additional guidance. Answering “Yes” to the question regarding ready for close out will still require continued reporting. This question is for informational purposes only. - Project Start and End Dates

Beginning in Reporting Period Q1 2024 there will be required fields for Project Start and End Dates that are conditionally required based on the ‘Status of Completion’ in the Project Overview section. If the project status is ‘Not Started’ the dates are not required. If the project is ‘Completed less than 50%’ or ‘Completed 50% or more’ then only the Project Start Date is required. If the project is ‘Completed’ then both the Project Start Date and Project End Date are required. - Title I Uploads

Previously reported Title I Projects will have a new upload requirement based on the Environmental Review response. If the response to the question ‘Indicate the type of environmental review required by the project’ was ‘Other’ there will be a requirement to upload four (4) documents.Four new document uploads are required:

- Treasury Approved Environmental Certification

- Treasury Approved Public Notice

- Treasury Approved Proof of Posting Public Notice

- Treasury Approved Authority to Use Grant Funds Notice

There are four notable changes to the system for the Q2 2024 reporting cycle. These are:

- New Administrative Expenditure Sub-Category added.

A new sub-category, “Costs Associated with Satisfying Certain Legal and Administrative Requirements of the SLFRF Program After Dec. 31, 2024” has been added as Expenditure Sub-Category 7.3. - Interagency Agreements (IAA) added to selection options for Subawards and Subrecipients.

Recipients should use this subaward type for obligations with agencies, departments, and parts of government receiving funds under IAAs. For interagency agreements, recipients will be required to attest that the agreement meets the requirements described in SLFRF FAQ 17.6 and indicate which of the following criteria the interagency agreement meets:- It imposes conditions on the use of funds by the agency, department, or part of government receiving funds to carry out the program.

- It governs the provision of funds from one agency, department, or part of government to another to carry out an eligible use of SLFRF funds.

- It governs the procurement of goods or services by one agency, department, or part of government from another.

- Option to estimate 2025 and 2026 personnel costs included for Direct Payment Subawards.

For projects involving personnel costs to be expended in 2025 and 2026 for positions established and filled by Dec. 31, 2024, recipients may report an estimate of such expenses and retain funds that they would otherwise have to return to Treasury after 2024 as unobligated. See SLFRF FAQs 17.7 and 17.8. Recipients should only report an estimate if funds are not obligated for those personnel costs through another mechanism, such as through a subaward, contract, or interagency agreement. For each project’s reported obligation, the estimate must be limited to estimated personnel costs associated with the individual project and may not include estimated costs associated with other projects. The estimate must be reported as its own “Direct Payment” subaward entry connected to the project. - Option to estimate contract change order and contingency expenses included for Contract Subaward Types.

For projects involving contracts that expressly provide for change orders or contingencies, a recipient may report an estimate of the amount of the amount that may be necessary to cover such changes or contingencies in 2025 and 2026 and retain funds that they would otherwise have to return to Treasury after 2024 as unobligated. The estimate must be limited to estimated costs associated with change orders or contingencies for the contract(s) associated with the individual project reported and may not cover expected costs associated with other contracts reported under separate projects. The estimate must be reported as its own “Contract” subaward entry connected to the project.

There are three notable changes to the system for the Q3 2024 reporting cycle. These are:

- Roles able to submit a report. (See page 7 of the October 2024 Project and Expenditure Report User Guide (pdf).) Starting in Q3 2024, both the Account Administrator and Authorized Representative will have the ability to submit the P&E Reports and the Recovery Plans.

- Alternative Compliance Examination Engagement (ACEE). (See page 80 of the October 2024 Project and Expenditure Report User Guide (pdf).) Additional ACEE Instructions provided on how to generate the ACEE in the Portal.

- Revenue Replacement. (See page 50 of the October 2024 Project and Expenditure Report User Guide (pdf).) Clarification about projects that must be submitted under EC 6 to total the amount selected as Revenue Replacement and to highlight that if there are projects in other EC categories, Treasury will assume that projects reported under other ECs are not revenue replacement funded and the regulations for those ECs will apply for compliance purposes even if the report indicates a revenue replacement amount.

Obligations

Q45: What is the definition of “obligated?”

A45: An order placed for property and services and entry into contracts, subawards, and similar transactions that require payment, which may include:

- An order placed for property or services.

- Contract.

- Subaward.

- Similar transactions that require payment, which may include:

- Certain interagency agreements (pdf) (including Memos of Understanding MOUs) (see FAQ 17.6).

- Under certain circumstances, payroll expenses for recipients’ employees (see FAQ 17.7).

(US Code of Federal Regulations)

The U.S. Treasury has further clarified that “similar transactions that require payment” may include certain and, under certain circumstances, payroll expenses for recipients’ employees.

Consequently, municipalities must do more than budget their SLFRF dollars — they must allow extra time to place orders and negotiate contracts. Finalizing obligations, including funds used for revenue replacement (standard allowance for example), includes reporting the obligation through the normal reporting process.

Under the revised definition of “obligation,” the term continues to mean an order placed for property and services and entry into contracts, subawards, and similar transactions that require payment. Under the Obligation IFR, a recipient is also considered to have incurred an obligation by Dec. 31, 2024, with respect to a requirement under federal law or regulation or a provision of the SLFRF award terms and conditions to which the recipient becomes subject as a result of receiving or expending SLFRF funds.

Accordingly, under the second part of the definition of obligation set out above, a recipient may use SLFRF funds to cover costs related to:

- Reporting and compliance requirements, including subrecipient monitoring.

- Single Audit costs.

- Record retention and internal control requirements.

- Property standards.

- Environmental compliance requirements.

- Civil rights and nondiscrimination requirements.

Q46: What is NOT considered obligated?

A46: The following do not meet the definition of an obligation:

- Adopted budget or budget amendment.

- Appropriation of SLFRF funds.

- Executive order.

- Resolution.

- Written or oral intention to enter a contract.

- Grant of legal authority to enter a contract.

- Claiming funds under the revenue loss category.

- Moving SLFRF dollars to a general fund as revenue loss but not further establishing an obligation with those funds by 12/31/24 .

Q47: Is there a date that ARPA funds must be obligated?

A47: Dec. 31, 2024

Q48: If the standard allowance under the revenue replacement provision was elected, are funds automatically considered obligated?

A48: No. If a recipient is utilizing revenue loss to pay for government services, the recipient must report the use as project(s) under expenditure category 6.1. Recipients must enter a project description for any project entered under 6.1. Revenue loss project descriptions must summarize the project in sufficient detail to provide an understanding of the major activities that will occur. Descriptions should establish what the project seeks to accomplish and should include enough information to make clear how the recipient determined the project’s eligibility. For example, ARPA funds used to replace a compromised watermain may be reported as “Replace watermain to prevent contamination in accordance with EPA Drinking Water State Revolving Fund (pdf) eligibility.”

All SLFRF funds under any eligible use category are subject to the obligation requirements.

Q49: What if ARPA funds are not spent or properly obligated by Dec. 31, 2024?

A49: Unobligated funds must be returned to the U.S. Treasury.

Q50: Where is more information about obligating funds found?

A50: Recipients should look to the Obligation IFR (pdf) and Section 17 of the SLFRF FAQs (pdf) for information about the obligation requirement.